special (budget) Meeting of Council

Minutes

14 JULY 2014

special (budget) Meeting of Council

14 JULY 2014

|

14 JULY 2014 |

TABLE OF CONTENTS

Item Subject Page No.

Table of Contents.................................................................................................................... 2

4.1 Operational Plan 2014/2015

5.0 Corporate and Community Services Reports

5.1 2014/2015 Financial Policies

5.3 2014/2015 Revenue Statement

5.4 Adoption of the 2014/2015 Budget and Long Term Financial Forecast from 2014/2015 to 2023/2024

|

14 JULY 2014 |

ATTENDANCE:

· Cr Steve Jones (Mayor) (Chairperson) · Cr Tanya Milligan · Cr Kathy McLean · Cr Derek Pingel · Cr Janice Holstein

Officers Present · Ian Flint, Chief Executive Officer · Jason Bradshaw, Executive Manager Governance & Performance · Mark Piorkowski, Executive Manager Planning & Development Services · Myles Fairbairn, Executive Manager Infrastructure Works & Services · David Lewis, Executive Manager Corporate & Community Services · Jason Cubit, Executive Liaison Officer Mayor/CEO & Coordinator Mayor’s Office · Sarah Fox, Corporate Communications Manager · Rick Machin, Marketing & Communications Coordinator · Tony Brett, Manager Finance · Tony Trace, Manager Business Improvement · Stephen Hart, Manager Administration & Executive Operations · Susan Boland, Council Business Support Officer

Media Present · Jim Nichol, Valley Weekender · Derek Barry, Gatton Star

Apology · Cr Peter Friend · Cr Jim McDonald · Jamie Simmonds, Executive Policy Advisor Mayor/CEO · Dan McPherson, Executive Manager Organisational Development & Engagement |

The meeting commenced at 10.04 am

The Chairperson, Cr Jones opened the meeting and welcomed all present including a number of Council Officers involved in the preparation of the Budget Documentation.

This Special Meeting of Council is for the adoption of the 2014/15 Budget and 2014/15 Rates and Charges.

The Mayor made general introductory remarks on the budget and its preparation and acknowledged the support of the Council team in its preparation.

The meeting proceeded in accordance with the agenda and the Mayor presented the Budget address.

Date: 10 July 2014

Author: Ian Flint, Chief Executive Officer

Responsible Officer: Ian Flint, Chief Executive Officer

File No: Formal Papers

|

THAT Leave of Absence be noted to have been granted to Cr Friend due to Annual Leave. And further; THAT Leave of Absence be granted to Cr McDonald due to Annual Leave.

Moved By: Cr Holstein Seconded By: Cr McLean Resolution Number: 3551

CARRIED 5/0 |

2.0 Declaration of any Material personal interests/conflicts of interest by councillors and senior council officers

2.1 Declaration of Material Personal Interest on any Item of Business

Pursuant to Section 172 of the Local Government Act 2009, a councillor who has a material personal interest in an issue to be considered at a meeting of the local government, or any of its committees must –

(a) inform the meeting of the councillor’s material personal interest in the matter; and

(b) leave the meeting room (including any area set aside for the public), and stay out of the meeting room while the matter is being discussed and voted on.

2.2 Declaration of Conflict of Interest on any Item of Business

Pursuant to Section 173 of the Local Government Act 2009, a councillor who has a real or perceived conflict of interest in a matter to be considered at a meeting of the local government, or any of its committees must inform the meeting about the councillor’s personal interest the matter and if the councillor participates in the meeting in relation to the matter, how the councillor intends to deal with the real or perceived conflict of interest.

There were no interests declared pertaining to this special budget meeting.

3.0 Mayor’s Budget Message

I am pleased to announce the 2014/15 Lockyer Valley Regional Council Budget contains no increase to general rates for the majority of residential property owners and farming businesses.

This financial year we have made the conscious decision not to levy a rate rise on our residents and to offset this with cost savings due to efficiency measures and productivity improvements. We will continue to focus our organisation on being more productive, on improving our systems, reviewing our processes, realigning our priorities and core services and in being more efficient in how we deliver services to our community.

This is a positive budget which, along with having no increase in general rates levied for the majority of residential properties and farming businesses, will see Council deliver on its commitments and reward ratepayers for bearing the brunt of previous rate rises which were as a result of costs associated with recent floods.

While cost of living pressures such as electricity, water and insurance continue to increase the burden on people, Council has been able to review its own operations to reduce costs and introduce savings and thus eliminate an increase to general rates for the majority of residents and farmers for this financial year. These cost-saving productivity measures will continue into the future as Council transitions from a flood recovery focus back to a core service delivery mode.

In conjunction with a range of operating efficiencies, Council will capitalise on a number of its investments to maximum benefit for the community.

Focus on key projects

There are a number of highlights and key projects that Council will undertake during the financial year.

Council will deliver a new Planning Scheme which will set the direction and future land use options for the Lockyer Valley. The new planning scheme will be of major benefit to the region and will be the culmination of many months of work. Together with the economic development framework established for the region, the planning scheme positions Council well to facilitate further regional development and economic growth to sustain the Lockyer Valley into the future.

Council will continue its flood mitigation program to lessen the impact of flooding throughout the region on homes and businesses. This flood mitigation program will continue in conjunction with Council’s Natural Disaster Relief and Recovery Arrangements restoration work which will conclude during the year ahead. In partnership with the Federal and State Governments, Council will continue to complement these works with betterment components as funding approvals allow.

As well as investing in its infrastructure networks and development enablers, Council will keep on Rebuilding Lockyer Better using key economic drivers to promote the region to potential visitors, investors and new residents. Council will continue to partner with key industry representatives to showcase the region at special events and shows throughout the year.

Council will continue to deliver the region’s two major community infrastructure projects this financial year.

Work on the Lockyer Valley Aquatic Centre is due for completion in late 2014 with work having already started on the new Laidley Multipurpose Sports Complex at the Laidley Recreation Reserve which will be complete in early 2015. Both of these projects will leave a lasting legacy for future generations and will help to promote and increase the Lockyer Valley’s proud sporting history.

Council will also invest a significant portion of this budget getting back to basics with its road maintenance and pest management programs which are important to the way of life for the majority of our residents.

$750,000 goes back to community

Lockyer Valley community, sporting and not-for-profit groups are further big winners in this budget with $750,000 allocated through Council’s Community Assistance Grants to allow these groups to undertake projects, stage events and contribute to the ongoing wellbeing of the community.

In this budget, some larger commercial premises will see increases in their general rates, with many now in-line and paying similar rates to comparable Council regions across Queensland. Council has adjusted the mix of its rates revenue in looking at how commercial premises are rated compared to residential properties.

There will be a small increase of less than 20 cents per week in Council’s Waste, Recycling and Collection charge on the two-bin system which is now fully operational across the region. Residents across the region have embraced the new two-bin waste and recycling system with a mammoth increase in the amount of material being recycled which in turn avoids being deposited in landfill.

Unfortunately Council is continuing to be forced by the State Government to collect their Emergency Management Fire and Rescue Levy and this will be included as a separate bill delivered with each rates notice.

Levies reduced and streamlined

No increase on general rates for the majority of residential property owners and farmers has been done in conjunction with a streamlining and reduction of levies.

Council has been able to streamline and eliminate some levies that ratepayers had previously paid. There will now be two levies only, being the Rural Fire Levy which remains unchanged at $15 for six months and an Emergency Preparedness Levy of $50 for six months. The Emergency Preparedness Levy will fund infrastructure restoration projects, NDRRA funding shortfalls and interest and redemption payments on loans associated with NDRRA recovery work.

A separate Waste Management Charge streamlines the previous Waste Management and Environment Levies into one and will be $72.50 for six months.

Council has been able to deliver a 12.7 per cent reduction in the cost of its levies and separate charges meaning the bottom line for many residential ratepayers will be a decrease in total cost of their rates bill from the previous year.

The reduction in the cost and number of levies, coupled with no increase to general rates for residential properties and the majority of farmers, is an important pillar of this budget and is one of many positive outcomes.

Support for Pensioners

Pensioners are well supported in this budget with a 50 per cent increase in Council’s Pensioner Subsidy meaning many pensioners will pay less in their Council rates than the previous year.

Council is well and truly on its way to producing a balanced budget while at the same time reducing the cost of living pressures on families in the Lockyer Valley.

This is a significant achievement given the recent cutbacks in government funding and resultant pressures on our revenue stream. The impacts of the costs associated with the State Government pushing further responsibilities on to Local Governments are being felt right across Queensland. The fact that this Council has been able to shoulder those tasks and still deliver no increase in general rates levied for the majority of residents and farmers in this budget is an achievement to be applauded.

I thank the Councillors and Council’s Executive team for their time and efforts in compiling this budget which I commend as responsive and responsible to community needs and expectations and I’m confident it sets the Lockyer Valley on a positive pathway into the future.

|

14 JULY 2014 |

4.0 Executive Office Reports

4.1 Operational Plan 2014/2015

Date: 08 July 2014

Author: Anthony Trace, Manager Business Improvement & Program Performance

Responsible Officer: Jason Bradshaw, Executive Manager Governance & Performance

File No: Formal Papers

Summary:

The Local Government Act and Regulations require that the Chief Executive Officer present to the Council before the adoption of the Budget, the Operational Plan and its Activities as well as the future directions for the community and the organisation consistent with its Corporate Plan.

The Operational Plan for 2014/2015 is based on the Corporate Plan from 2012/2017, with the key strategic themes based upon the adopted Community Plan.

Officer’s Recommendation:

THAT Council resolves to adopt the Operational Plan for 2014/2015.

|

THAT Council resolves to adopt the Operational Plan for 2014/2015.

Moved By: Cr Milligan Seconded By: Cr Pingel Resolution Number: 3552

CARRIED 5/0 |

Report

1. Introduction

Each year the activities of the organisation are based upon the strategies developed in the Corporate Plan and these are actioned through tasks assigned in the Operational Plan. This year there has been a review of the Operational Plan to separate Council’s ongoing service delivery from community and organisational strategies.

2. Background

Council sets a Corporate Plan in consultation with the community that outlines the vision and future direction of the organisation and the community for a period of up to five (5) years. Each year the Council is required to adopt an Operational Plan that contributes to the achievement of the goals outlined in the Corporate Plan.

The 2014/2015 Operational Plan provides the detail of the key programs and identified outcomes to be achieved against the Corporate Plan for the 2014/2015 financial year.

3. Report

The Annual Operational Plan 2014/2015 (attached) is provided for adoption before Council considers and accepts the 2014/2015 Budget.

Section 104(5)(a) of the Local Government Act 2009, identifies the Annual Operational Plan as one of the key financial planning documents of Council. The Annual Operational Plan is required to be prepared under Section 174(1) of the Local Government Regulation 2012 and must be consistent with the annual budget, showing how Council will progress the implementation of the 5 year Corporate Plan and state how Council will manage its operational risks. Section 174(5) of the Local Government Regulation 2012 requires Council to discharge its responsibilities in a way that is consistent with its annual operational plan.

As such, the 2014/2015 Budget forms part of this Operational Plan 2014/2015 which is presented in accordance with the legislative requirements from the Local Government Act and the Local Government Regulation 2012.

The Operational Plan 2014/2015 has been developed in consultation with staff and through the management team across the organisation over recent weeks. Initial outcomes from the Service Review and workforce planning projects have been used to identify Council’s ongoing service provision and separately identify its community and organisational strategies and initiatives.

While the operational initiatives will continue to be reported on a quarterly basis to Council, during the 2014/2015 financial year the delivery of Council’s services will be reported regularly on a by exception basis (positive and negative) via the quarterly reporting on the Operational Plan.

This plan has direct linkages to the Corporate and Community Plans and directs the key initiatives to the undertaken throughout the year.

4. Policy and Legal Implications

Section 174(1) of the Local Government Regulation 2012 requires Council to prepare and adopt an annual Operational plan for each financial year. Further, Section 175(1) Local Government Regulation 2012 requires that the Operational Plan must be consistent with Council’s Annual Budget, state how Council will progress the implementation of the 5 year Corporate Plan during the period of the annual Operational Plan, manage operational risks and include as annual performance plan for each commercial business unit of Council.

5. Financial and Resource Implications

The financial performance of each of the key strategies is summarised and can provide an indication on the progress of initiatives or of constraints in delivering outcomes for the Operational Plan. Overall, the financial performance aligns with the budget and allocation of resources to deliver the outcomes. The financial allocations of the Budget are included in the Operational Plan against each key strategic theme.

6. Delegations/Authorisations

No delegations are required for this report and existing authorities are appropriate for the delivery of the Operational Plan outcomes.

7. Communication

The significant achievements of the Operational Plan are regularly reported through corporate communications and media channels as required. The overall achievements from all quarterly reporting will contribute to the Annual Report.

8. Conclusion

The Operational Plan 2014/2015 is to be adopted as part of the overall Annual Budget process and it is recorded that the Operational Plan as tabled be approved.

|

14 JULY 2014 |

5.0 Corporate and Community Services Reports

5.1 2014/2015 Financial Policies

Date: 09 July 2014

Author: Tony Brett, Manager Finance

Responsible Officer: David Lewis, Group Manager Corporate & Community Services

File No: Formal Papers

Summary:

The Local Government Regulation 2012 Sections 191 and 192 require Council to prepare an investment policy and a debt policy. The debt policy is required to be adopted each financial year with the investment policy reviewed on an annual basis.

Both policies have been reviewed as part of the 2014/2015 Budget process with the Investment Policy remaining unchanged and the Debt Policy updated to reflect Council’s revised forecast borrowings.

The adoption of these policies satisfies Council’s legislative obligations and provides clear guidance to staff to ensure ongoing understanding and compliance.

Officer’s Recommendation:

THAT Council adopts the 2014/2015 Investment Policy and the 2014/2015 Debt Policy.

|

THAT Council adopts the 2014/2015 Investment Policy and the 2014/2015 Debt Policy.

Moved By: Cr Pingel Seconded By: Cr Holstein Resolution Number: 3553

CARRIED 5/0 |

Report

1. Introduction

The Local Government Regulation 2012 requires Council to adopt or review specified policies each financial year.

2. Background

The Investment Policy and Debt Policy are key statutory policies of Council.

3. Report

The Local Government Regulation 2012 requires Council to prepare an investment policy and debt policy.

Under Section 191 of the Local Government Regulation 2012, Council must prepare and adopt an investment policy that outlines Council’s investment objectives and overall risk philosophy together with the procedures for achieving the goals outlined in the policy.

The attached Investment Policy provides Council’s finance officers with an investment framework within which to place Council investments to achieve competitive returns whilst adequately managing risk exposure and ensuring cash funds are available to meet Council’s short term cash requirements. In order of priority, the order of investment activities is preservation of capital, liquidity and return.

Under Section 192 of the Local Government Regulation 2012, Council must also prepare and adopt a debt policy each financial year. The debt policy must state new borrowings for the current financial year and the next nine years and the time over which Council plans to repay existing and new borrowings.

The attached Debt Policy forecasts additional borrowing of $1.75 million in the 2014/2015 financial year with no further borrowings planned for the next nine years. The additional borrowings in 2014/2015 are associated with the completion of the Regional Aquatic Centre.

Under Council’s Debt Policy, Council will not utilise loan funds to finance operating activities and where capital assets are funded through borrowings, Council will repay the loans within a term not exceeding the life of the asset. Current loans are planned to be repaid within 20 years.

4. Policy and Legal Implications

The adoption of these policies satisfies Council’s legislative obligations under the Local Government Regulation 2012 and provides clear guidance to staff to ensure ongoing understanding and compliance.

5. Financial and Resource Implications

These policies underpin key elements of the 2014/2015 budget.

6. Delegations/Authorisations

No further delegations are required to manage the issues raised in this report. The Chief Executive Officer will manage the requirements in line with existing delegations.

7. Communication and Engagement

The implications of these policies will be incorporated into extensive communications associated with the 2014/2015 Budget.

8. Conclusion

These policies are used in the formulation of Council’s annual budget and have been reviewed as part of the 2014/2015 Budget process with the Investment Policy remaining unchanged and the Debt Policy updated to reflect Council’s new borrowings forecast.

9. Action/s

Update Council’s Policy Register and upload to the internet.

|

14 JULY 2014 |

Date: 09 July 2014

Author: Tony Brett, Manager Finance

Responsible Officer: David Lewis, Group Manager Corporate & Community Services

File No: Formal Papers

Summary:

Section 169 (2) (c) of the Local Government Regulation 2012 requires Council to include a Revenue Policy in its annual budget.

Section 193 (3) of the Local Government Regulation 2012 requires Council to review its Revenue Policy annually and in sufficient time to allow an annual budget that is consistent with the revenue policy to be adopted for the next financial year. The 2014/2015 Revenue Policy has been comprehensively reviewed as part of the 2014/2015 budget process.

The purpose of the Revenue Policy is to set out the principles used by Lockyer Valley Regional Council for:

· the making and levying rates and charges;

· determining the purpose of and the granting of concessions for rates and charges;

· recovering overdue rates and charges;

· methods for setting cost recovery fees; and

· the extent to which physical and social infrastructure costs for new developments are to be funded by charges for the development.

Council levies rates and charges to fund the provision of valuable services to our community. When adopting its annual budget, Council will set rates and charges at a level that will provide for both current and future community requirements. Council also provides concessions to pensioners to assist property owners to remain in their own homes and concessions to non-profit community, sporting and cultural groups as they contribute to the health and well-being of the community and to the social cohesion of the region.

The 2014/2015 Revenue Policy has been comprehensively reviewed since the adoption of the 2013/2014 Budget.

Officer’s Recommendation:

THAT Council resolves to adopt, pursuant to Section 193 of the Local Government Regulation 2012, the 2014/2015 Revenue Policy (Attachment 1) for inclusion in the 2014/2015 Budget.

|

THAT Council resolves to adopt, pursuant to Section 193 of the Local Government Regulation 2012, the 2014/2015 Revenue Policy (Attachment 1) for inclusion in the 2014/2015 Budget.

Moved By: Cr Milligan Seconded By: Cr Pingel Resolution Number: 3554

CARRIED 5/0 |

Report

1. Introduction

Council is required under Section 169 (2) (c) of the Local Government Regulation 2012 to include a Revenue Policy in its annual budget.

This report recommends the adoption of the Revenue Policy as part of the 2014/2015 Budget.

2. Background

The Revenue Policy is a key statutory policy of Council to be adopted as part of the annual budget. The Revenue Policy is reviewed every year as part of the budget development process. Changes made to the document reflect the wishes of Council in making and levying rates for the coming financial year.

3. Report

Section 193 (3) of the Local Government Regulation 2012 requires Council to review its Revenue Policy annually and in sufficient time to allow an annual budget that is consistent with the revenue policy to be adopted for the next financial year.

The purpose of the Revenue Policy is to set out the principles used by Lockyer Valley Regional Council for:

· the making and levying rates and charges;

· determining the purpose of and the granting of concessions for rates and charges;

· recovering overdue rates and charges;

· methods for setting cost recovery fees; and

· the extent to which physical and social infrastructure costs for a new developments are to be funded by charges for the development.

Council levies rates and charges to fund the provision of valuable services to our community. When adopting its annual budget Council will set rates and charges at a level that will provide for both current and future community requirements. Council also provides concessions to pensioners to assist property owners to remain in their own homes, concessions to non-profit community, sporting and cultural groups as they contribute to the health and well-being of the community and to the social cohesion of the region.

The Revenue Policy also sets out the principles that will apply in the management of and recovery of debt. These principles are as follows:

· transparency by making clear the obligations of ratepayers and the processes used by Council in assisting them to meet their financial obligations;

· efficiency by ensuring the processes used to recover overdue rates and charges are simple to administer and cost effective;

· equity by having regard to providing the same treatment for ratepayers with similar circumstances; and

· flexibility by responding where necessary to changes in the local economy.

The 2014/2015 Revenue Policy has been reviewed as part of the 2014/2015 budget process with minor changes being made.

Section 169 (2) (c) of the Local Government Regulation 2012 requires Council to include a Revenue Policy in its annual budget.

4. Policy and Legal Implications

The adoption of the Revenue Policy ensures Council’s compliance with the requirements of the Local Government Regulation 2012.

5. Financial and Resource Implications

The adoption of the 2014/2015 Revenue Policy ensures that Council can rate in accordance with the proposed 2014/2015 Budget.

6. Delegations/Authorisations

No further delegations are required to manage the issues raised in this report. The Chief Executive Officer will manage the requirements in line with existing delegations.

7. Communication and Engagement

The implications of the 2014/2015 Revenue will be incorporated into extensive communications associated with the 2014/2015 Budget.

8. Conclusion

The 2014/2015 Revenue Policy is used in the formulation of Council’s 2014/2015 Revenue Statement and 2014/2015 Budget and must be included in the adoption of the annual budget each financial year. Council’s annual budget must be consistent with its Revenue Policy.

9. Action/s

1. Council to adopt the attached Revenue Policy as required under the Local Government Regulation 2012

2. The Revenue Policy to be used used in the formulation of Council’s 2014/2015 Revenue Statement and 2014/2015 Budget.

|

14 JULY 2014 |

5.3 2014/2015 Revenue Statement

Date: 10 July 2014

Author: Tony Brett, Manager Finance

Responsible Officer: David Lewis, Group Manager Corporate & Community Services

File No: Formal Papers

Summary:

Section 169(2)(b) of the Local Government Regulation 2012 requires Council to include a Revenue Statement in its annual budget.

The 2014/2015 Revenue Statement is an explanatory statement, detailing the revenue measures adopted in Council’s 2014/2015 Budget. The Revenue Statement has been reviewed as part of Council’s budget process and provides the basis for the generation of Council’s rates revenue for 2014/2015.

The 2014/2015 Revenue Statement will achieve an initial yield of $33.03 million in rates and utility charges with $1.2 million allowed for discounts and remissions. Budget parameters include a conservative growth rate of 1.0%.

Officer’s Recommendation:

THAT Council resolves to:

a) Adopt, pursuant to Sections 80 and 81 of the Local Government Regulation 2012, the different categories of rateable land and a description of those contained in Table 1 of the 2014/2015 Revenue Statement as follows:

|

No |

Name |

Description |

|

1 |

Commercial $0 <or= $200,000 |

Land used for commercial purposes, other than primary production, with a rateable value less than or equal to $200,000, other than land included in category 5 to 11, 17-20 or 37 to 39. |

|

2 |

Commercial $200,001 & </=$700,000 |

Land used for commercial purposes, other than primary production, with a rateable value greater than $200,000 and up to or equal to $700,000, other than land included in category 5 to 11, 17-20 or 37 to 39. |

|

3 |

Commercial > $700,001 & </=$2M |

Land used for commercial purposes, other than primary production, with a rateable value greater than $700,000 and less than or equal to $2M, other than land included in category 5 to 11, 17-20 or 37 to 39. |

|

4 |

Commercial > $2Million+ |

Land used for commercial purposes, other than primary production, with a rateable value greater than $2M, other than land included in category 5 to 11, 17-20 or 37 to 39. |

|

5 |

Shopping Centres & Supermarkets </= $1Million |

Land used for commercial purposes as shopping centres and/or supermarkets, with a rateable value of less than or equal to $1 million. |

|

6 |

Shopping Centres & Supermarkets >$1Million+ |

Land used for commercial purposes as shopping centres and/or supermarkets, with a rateable value greater than $1milion. |

|

7 |

Drive-In Shopping Centres </= 7000 sq m |

Land used or capable of being used for a drive-in shopping centre that has a property land area of up to or equal to 7000 sq metres, and less than or equal to 120 onsite carparking spaces. |

|

8 |

Major Drive-In Shopping Centres >7000 sq m |

Land used or capable of being used for a drive-in shopping centre that has a property land area greater than 7000 sq metres. and more than 120 onsite carparking spaces. |

|

9 |

Workers Accommodation |

Land used or intended to be used, in whole or in part, for the provision of intensive accommodation for more than 50 persons (other than the ordinary travelling public) in rooms, suites, dongas or caravan sites specifically built or provided for this purpose. Land within this category is commonly known as “workers accommodation”, “single persons quarters”, “work camps”, “accommodation village”,” barracks”, etc. |

|

10 |

Motels |

Land used as a motel. |

|

11 |

Caravan Parks |

Land used as a caravan park.

|

|

12 |

Farming/Agriculture $0-$200,000 |

Land used for farming or agricultural purposes with a rateable value of less than $200,000, except land included in categories 25-29. |

|

13 |

Farming/Agriculture $200,001-$380,000 |

Land used for farming or agricultural purposes with a rateable value between $200,001 and $380,000, except land included in categories25-29. |

|

14 |

Farming/Agriculture $380,001-$610,000 |

Land used for farming or agricultural purposes with a rateable value between $380,001 and $610,000, except land included in categories 25-29.

|

|

15 |

Farming/Agriculture >or= $610,001 |

Land used for farming or agricultural purposes with a rateable value of $610,001 or greater, except land included in categories 25-29. |

|

16 |

Rural Residential

|

Land used for residential purposes that is within the Rural Fire Service boundaries |

|

17 |

Service Stations/Garages </=100,000 litres |

Land used, in whole or in part, for fuel retailing where these is/is not an associated shop and/or fuel outlet and onsite bulk fuel storage of up to and including 100,000 litres. In addition, the category includes any land used for a fuelling area, fuel storage area, retail shop or parking area associated with land used for fuel retailing. |

|

18 |

Service Stations/Garages 100,001 to 200,000 litres |

Land used, in whole or in part, for fuel retailing where there is/is not an associated shop and/or fuel outlet and onsite bulk fuel storage of between 100,001 and up to and including 200,000 litres. |

|

19 |

Service Stations/Garages Over 200,000 litres

|

Land used, in whole or in part, for fuel retailing where there is an associated shop and/or fuel outlet and onsite bulk fuel storage of more than 200,000 litres. |

|

20 |

Services Stations & Garages without Shops or Food Outlets >200,000 litres |

Land used, in whole or in part, for fuel retailing where there is not any associated shop and/or fuel outlet and onsite bulk fuel storage of more than 200,000 litres. |

|

21 |

Transmission Sites |

Land used or intended to be used for the transmission or distribution of electricity from a coal or gas-fired power plant including, but not limited to, a substation.

|

|

22 |

Gas Compressor Sites |

Land used or intended to be used for the transportation of gas under compression and/or any purpose associated or connected with the transportation of gas under compression. |

|

23 |

Power Stations |

Land used or intended to be used for or ancillary to the generation of electricity from a coal and/or gas fired power station. |

|

24 |

Urban Residential |

Land used for urban residential purposes that is not within the Rural Fire Service boundaries. |

|

25 |

Farming/Agriculture On Farm Packing Operation |

Land used or intended to be used for farming or agricultural purposes containing an on farm packing operation. An on farm packing operation: shall mean land containing a facility where fruit and/or vegetables are received and/or processed prior to distribution to market. Operations may include but are not limited to sorting, trimming, washing, drying, waxing, curing, chemical treatment, packaging, pre-cooling, storage, and transportation.

|

|

26 |

Intensive Agriculture Poultry </=200,000 birds |

Land used for intensive poultry farming with an approved capacity of up to or equal to 200,000 birds. |

|

27 |

Intensive Agriculture Poultry 200,001 birds and over |

Land used for intensive poultry farming with an approved capacity of over 200,000 birds.

|

|

28 |

Intensive Agriculture Piggeries </=3,000 SPU |

Land used for intensive pig farming with an approved capacity of up to or equal to 3,000 SPU. |

|

29 |

Intensive Agriculture Piggeries 3,001 SPU and over |

Land used for intensive pig farming with an approved capacity of over 3,000 SPU. |

|

31 |

Land which is Subject to Chapter 2, Part 2, Subdivision 3 of the Land Valuation Act 2010 |

Land which is subject to chapter 2, part 2subdivision 3 of the Land Valuation Act 2010. |

|

32 |

Nursing Homes/Retirement Villages |

Land used for the provision private medical care, the provision of aged care nursing or as a retirement home. |

|

33 |

Sporting Clubs & Facilities |

Land used for sporting clubs and facilities associated with a sporting club where the operator does not hold a liquor and/or gaming licence, except land included in category 34. |

|

34 |

Licensed Clubs & Sporting Clubs |

Land used for the operation of a sporting club and facilities associated with a sporting club where the land is subject to a liquor and/or gaming licence. |

|

36 |

Sundry Purposes |

Land used for a permit to occupy, water storage, or a pump site and land which is not otherwise categorized.

|

|

37 |

Extractive & Mining Lease > 100,000tonnes. |

Land used for extractive industry and land which is a mining lease, where more than 100,000 tonnes of material is removed per annum. |

|

38 |

Extractive & Mining Lease 5,001 tonnes – 100,000 tonnes. |

Land used for extractive industry and land which is a mining lease, where between 5,001 and 100,000 tonnes of material is removed per annum. |

|

39 |

Extractive & Mining Lease up to 5,000 tonnes. |

Land used for extractive industry and land which is a mining lease, where up to 5,000 tonnes of material is removed per annum. |

|

40 |

Noxious/Offensive Industry – Explosive Factories |

Land used, or intended to be used, in the manufacture and/or storage of explosives. |

|

41 |

Noxious/offensive Industry – Abattoirs |

Land used, or intended to be used, as an abattoir having more than 20 employees and a valuation greater than $500,000. |

|

42 |

Noxious/offensive Industry – Other |

Land used, or intended to be used, for the purpose of a sawmill, tannery or any other industrial purpose or any use associated or connected with an industrial purpose, other than land included in categories 40 or 41. |

b) Delegate to the CEO the power (contained in Sections 81(4) and (5) of the Local Government Regulation 2012) of identifying the rating category to which each parcel of rateable land belongs.

c) Adopt pursuant to Section 169 (2)(b) of the Local Government Regulation 2012 the 2014/2015 Revenue Statement (Attachment 1) for inclusion in the 2014/2015 Budget.

d) Adopt, pursuant to Section 94 of the Local Government Regulation 2012, the overall plan for the special charge for Rural Fire.

e) Adopt, pursuant to Section 103 of the Local Government Regulation 2012, the separate charge for the Emergency Preparedness Levy.

f) Adopt, pursuant to Section 94 of the Local Government Act 2009 the levying of differential general rates, minimum general rates, special charges, utility charges and separate charges for the 2014/2015 financial year at the values included within the 2014/2015 Revenue Statement.

g) Adopt, pursuant to Section 118 of the Local Government Regulation 2012, that rates and charges must be paid within 30 days of the issuing of rates notices.

h) Adopt, pursuant to Section 133 of the Local Government Regulation 2012, that interest at the rate of 11% per annum will be charged on all overdue rates.

i) Allow a discount for the prompt payment of rates and charges pursuant to Section 130 of the Local Government Regulation 2012 in accordance with the 2014/2015 Revenue Statement.

j) Allow payment of certain rates or charges by instalments and concessions to certain classes of ratepayer pursuant to Part 10 Concessions of the Local Government Regulation 2012 in accordance with the 2014/2015 Revenue Statement and

k) Levy all rates (as defined in the Local Government Act 2009) on a half yearly basis with payment due on or before the due date for payment as shown on the rates notice.

|

THAT Council resolves to:

a) Adopt, pursuant to Sections 80 and 81 of the Local Government Regulation 2012, the different categories of rateable land and a description of those contained in Table 1 of the 2014/2015 Revenue Statement as follows:

b) Delegate to the CEO the power (contained in Sections 81(4) and (5) of the Local Government Regulation 2012) of identifying the rating category to which each parcel of rateable land belongs.

c) Adopt pursuant to Section 169 (2)(b) of the Local Government Regulation 2012 the 2014/2015 Revenue Statement (Attachment 1) for inclusion in the 2014/2015 Budget.

d) Adopt, pursuant to Section 94 of the Local Government Regulation 2012, the overall plan for the special charge for Rural Fire.

e) Adopt, pursuant to Section 103 of the Local Government Regulation 2012, the separate charge for the Emergency Preparedness Levy.

f) Adopt, pursuant to Section 94 of the Local Government Act 2009 the levying of differential general rates, minimum general rates, special charges, utility charges and separate charges for the 2014/2015 financial year at the values included within the 2014/2015 Revenue Statement.

g) Adopt, pursuant to Section 118 of the Local Government Regulation 2012, that rates and charges must be paid within 30 days of the issuing of rates notices.

h) Adopt, pursuant to Section 133 of the Local Government Regulation 2012, that interest at the rate of 11% per annum will be charged on all overdue rates.

i) Allow a discount for the prompt payment of rates and charges pursuant to Section 130 of the Local Government Regulation 2012 in accordance with the 2014/2015 Revenue Statement.

j) Allow payment of certain rates or charges by instalments and concessions to certain classes of ratepayer pursuant to Part 10 Concessions of the Local Government Regulation 2012 in accordance with the 2014/2015 Revenue Statement and

k) Levy all rates (as defined in the Local Government Act 2009) on a half yearly basis with payment due on or before the due date for payment as shown on the rates notice.

Moved By: Cr Pingel Seconded By: Cr Milligan Resolution Number: 3555

CARRIED 5/0 |

Report

1. Introduction

Council is required under Section 169 (2)(b) of the Local Government Regulation 2012 to include a revenue statement in its annual budget.

This report recommends the adoption of the Revenue Statement as part of the 2014/2015 Budget.

2. Background

The Revenue Statement is one of the key statutory documents of Council and is required to be adopted as part of the annual budget. The Revenue Statement is reviewed every year as part of the budget development process. Changes made to the document reflect the wishes of Council in making and levying rates for the coming financial year.

3. Report

Section 172 of the Local Government Regulation 2012 details what must be included in the Revenue Statement and Section 193 (2) states that the guidelines for preparing the Revenue Statement may be included in the Revenue Policy.

Following a series of budget workshops, Council is now in a position to formalise its Revenue Statement for the 2014/2015 financial year.

In 2014/2015, general rates revenue will continue to be levied using a system of differential rating. The system includes forty differential categories.

The Department of Natural Resources and Mines has issued new valuations for the region for 2014/2015 with an overall decrease of 4.63%. Extensive rates modelling has been undertaken to incorporate the new valuations into Council’s differential rating scheme with new classifications added and the rate in the dollar adjusted to reflect the change in valuations, whilst enabling the maintenance of overall rating revenue.

The key inclusions in the attached Revenue Statement include:

· an overall nil general rate increase with respect to Urban Residential, Rural Residential and the Agricultural sectors. Noting that the rates levied on individual properties will vary in accordance with their valuation adjustment circumstances;

· a targeted average general rate increase of 2.5% with respect to the general Commercial sector;

· a targeted average general rate increase of 5% with respect to the Extractive Industry sector;

· the introduction of revised rating categories with respect to service stations/garages, based on their individual fuel storage capacities;

· the introduction of revised rating categories with respect to Shopping Centres and Supermarkets, creating two Drive-In Shopping Centre categories, based on their property land areas;

· the introduction of additional rating categories with respect to Intensive Agriculture (Piggeries and Poultry) and On Farm Packing Operations;

· the introduction of additional rating categories with respect to Transformer Sites, Compressor Sites, Explosive Factories and Abattoirs;

· the continuation of the waste recycling scheme, with $10 per annum added to domestic waste collection charges and $5 per annum added to the Waste Management charge to fund this service;

· the separate charge – State Emergency Service Levy has been discontinued;

· the separate charge - Environmental Levy has been discontinued;

· The separate charge - Disaster, Restoration & Resilience Levy has been renamed the Emergency Preparedness Levy and is to be applied to fund infrastructure projects through agreed community recovery programs and recurrent and capital expenditure for volunteer state emergency service units;

· retention of early payment discounts of 5% on general rates and waste collection charges; and

· retention and an increase in the amount of pensioner remissions; and

· the Special Charge for Rural Fire Brigades remains unchanged at $30 per assessment.

The 2014/2015 Revenue Statement will achieve an initial yield of $33.03 million in rates and utility charges with $1.2 million allowed for discounts and remissions. Budget parameters include a conservative growth rate of 1.0%. The overall general rate revenue increase for 2014/2015 is 3.97%. However, when the changes to the levies, charges and other rates are taken into account, the overall increase in revenue is 1.46%. Table 1 shows the change in yield by comparing the amounts levied for each category in 2013/2014 to the budgeted amounts for 2014/2015.

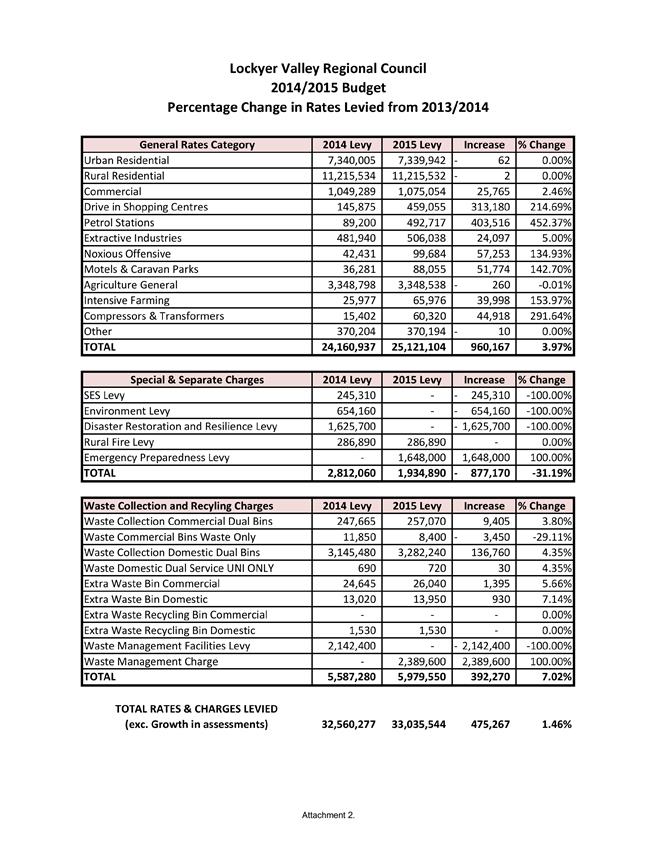

Table 1 – Changes in Rates Levied 2013/2014 to 2014/2015

|

General Rates Category |

2014 Levy |

2015 Levy |

Increase |

% Change |

|

Urban Residential |

7,340,005 |

7,339,942 |

- 62 |

0.00% |

|

Rural Residential |

11,215,534 |

11,215,532 |

- 2 |

0.00% |

|

Commercial |

1,049,289 |

1,075,054 |

25,765 |

2.46% |

|

Drive in Shopping Centres |

145,875 |

459,055 |

313,180 |

214.69% |

|

Petrol Stations |

89,200 |

492,717 |

403,516 |

452.37% |

|

Extractive Industries |

481,940 |

506,038 |

24,097 |

5.00% |

|

Noxious Offensive |

42,431 |

99,684 |

57,253 |

134.93% |

|

Motels & Caravan Parks |

36,281 |

88,055 |

51,774 |

142.70% |

|

Agriculture General |

3,348,798 |

3,348,538 |

- 260 |

-0.01% |

|

Intensive Farming |

25,977 |

65,976 |

39,998 |

153.97% |

|

Compressors & Transformers |

15,402 |

60,320 |

44,918 |

291.64% |

|

Other |

370,204 |

370,194 |

- 10 |

0.00% |

|

TOTAL |

24,160,937 |

25,121,104 |

960,167 |

3.97% |

|

Special & Separate Charges |

2014 Levy |

2015 Levy |

Increase |

% Change |

|

SES Levy |

245,310 |

- |

- 245,310 |

-100.00% |

|

Environment Levy |

654,160 |

- |

- 654,160 |

-100.00% |

|

Disaster Restoration and Resilience Levy |

1,625,700 |

- |

- 1,625,700 |

-100.00% |

|

Rural Fire Levy |

286,890 |

286,890 |

- |

0.00% |

|

Emergency Preparedness Levy |

- |

1,648,000 |

1,648,000 |

100.00% |

|

TOTAL |

2,812,060 |

1,934,890 |

- 877,170 |

-31.19% |

|

Waste Collection and Recycling Charges |

2014 Levy |

2015 Levy |

Increase |

% Change |

|

Waste Collection Commercial Dual Bins |

247,665 |

257,070 |

9,405 |

3.80% |

|

Waste Commercial Bins Waste Only |

11,850 |

8,400 |

- 3,450 |

-29.11% |

|

Waste Collection Domestic Dual Bins |

3,145,480 |

3,282,240 |

136,760 |

4.35% |

|

Waste Domestic Dual Service UNI ONLY |

690 |

720 |

30 |

4.35% |

|

Extra Waste Bin Commercial |

24,645 |

26,040 |

1,395 |

5.66% |

|

Extra Waste Bin Domestic |

13,020 |

13,950 |

930 |

7.14% |

|

Extra Waste Recycling Bin Commercial |

- |

- |

- |

0.00% |

|

Extra Waste Recycling Bin Domestic |

1,530 |

1,530 |

- |

0.00% |

|

Waste Management Facilities Levy |

2,142,400 |

- |

- 2,142,400 |

-100.00% |

|

Waste Management Charge |

- |

2,389,600 |

2,389,600 |

100.00% |

|

TOTAL |

5,587,280 |

5,979,550 |

392,270 |

7.02% |

|

TOTAL RATES & CHARGES

LEVIED |

32,560,277 |

33,035,544 |

475,267 |

1.46% |

Section 169(2)(b) of the Local Government Regulation 2012 requires Council to include a revenue statement in its annual budget.

4. Policy and Legal Implications

The 2014/2015 Revenue Statement is consistent with Council’s 2014/2015 Revenue Policy.

Advice has been sought from King and Co on Council’s Revenue Statement and the items contained within to ensure compliance with current legislation. As a result of their advice, some wording throughout the Revenue Statement has been amended for greater legislative compliance, but the intent of the rates and charges remain the same.

5. Financial and Resource Implications

The adoption of the 2014/2015 Revenue Statement ensures that Council can rate in accordance with the proposed 2014/2015 Budget.

The budget assumes a growth rate in assessments of 1.0%. As this is dependent on changes in the number of properties through land development, this growth may not always be achieved. The growth rate will need to be monitored throughout the year with any loss in revenue matched by corresponding expenditure reductions in formal amendments to Council’s 2014/2015 Budget.

The long term financial plan assumes annual rate increases on top of natural growth at between 2.5% and 3.5% over the next nine years. Natural growth in assessments is estimated at between 1.0% and 2.2%. Changes in the rate increase or natural growth estimates will impact on the amount of rates revenue generated and will affect Council’s long term sustainability, unless there are corresponding reductions in expenditure.

6. Delegations/Authorisations

No further delegations are required to manage the issues raised in this report. The Chief Executive Officer will manage the requirements in line with existing delegations.

7. Communication and Engagement

The implications of the 2014/2015 Revenue Statement will be incorporated into extensive communications associated with the 2014/2015 Budget.

8. Conclusion

Section 169 (2)(b) of the Local Government Regulation 2012 requires Council to include a Revenue Statement in its annual budget. The 2014/2015 Revenue Statement is an explanatory statement, detailing the revenue measures adopted in Council’s 2014/2015 Budget and provides the basis for the generation of Council’s rates revenue.

9. Action/s

1. Council to adopt the attached Revenue Statement which will be used as the basis for rating properties during the 2014/15 financial year.

|

14 JULY 2014 |

Cr Pingel proposed the Budget be put to Council, and offer the following comments:

In looking at this budget & working alongside of David and his team, I believe this has been a budget of restraint in right sizing Council and I think it is critically important that Council stay true to their operational budgets. Council needs to work smarter with less, I know that it is easily said but it is important. I also commend Dave Lewis and Tony Brett and their team on the work they have done on this budget because in my term on Council, particularly, I think this has been a tough budget to put together. Even though we are looking at a deficit budget we do see in the next couple of years we can come out with a positive cash flow and a positive budget that will get us back in the black and going forward for our community.

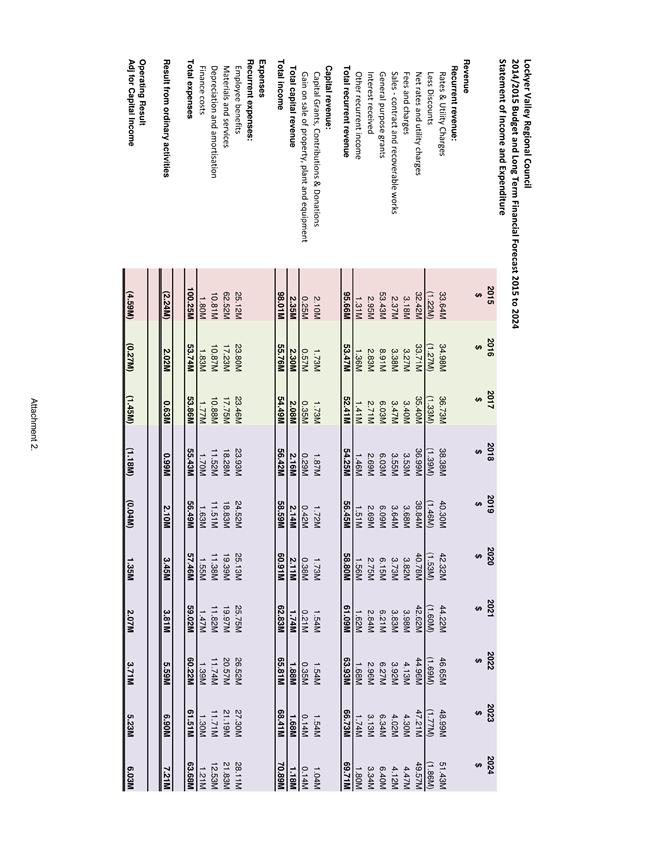

5.4 Adoption of the 2014/2015 Budget and Long Term Financial Forecast from 2014/2015 to 2023/2024

Date: 09 July 2014

Author: Tony Brett, Manager Finance

Responsible Officer: David Lewis, Group Manager Corporate & Community Services

File No: Formal Papers

Summary:

Under the Local Government Regulation 2012, Council must prepare an accrual based budget for each financial year which is consistent with the 5-year Corporate Plan and Annual Operational Plan. To comply with the Local Government Regulation 2012, Council must also publish results against a series of measures of financial sustainability for the budget year and the next nine (9) years.

The 2014/2015 budget will begin the process of realigning Council’s operations back to a sustainable level following the flood events of the past few years. As the flood restoration program nears completion, Council will return its focus to delivering its core services to the community in an efficient and cost effective manner. Saving initiatives contained in this budget will set the scene for Council’s future sustainability.

The 2014/2015 Budget presents an operating deficit of $2.24 million, including Council operations of $49.06 million, an infrastructure recovery program of $51.19 million and a capital works program of $13.95 million.

At a glance, some of the key highlights of the budget include:

· a total works program of $103.4 million (excluding depreciation);

· an overall nil general rate increase with respect to Urban Residential, Rural Residential and the Agricultural sectors. Noting that the rates levied on individual properties will vary in accordance with their valuation adjustment circumstances;

· the continuation of the waste recycling scheme, with $10 per annum added to domestic waste collection charges and $5 per annum added to the Waste Management charge to fund this service;

· removal of the separate charge – State Emergency Service Levy;

· removal of the separate charge - Environmental Levy;

· the separate charge - Disaster, Restoration & Resilience Levy has been renamed the Emergency Preparedness Levy and is to be applied to fund infrastructure projects through agreed community recovery programs and recurrent and capital expenditure for volunteer state emergency service units;

· retention of early payment discounts of 5% on general rates and waste collection charges; and

· retention and increase in the amount of pensioner remissions.

THAT Council resolves to

a. Note the Statement of Estimated Financial Position at 30 June 2014 (Attachment 1), as presented by the Chief Executive Officer in accordance with Section 205 of the Local Government Regulation 2012.

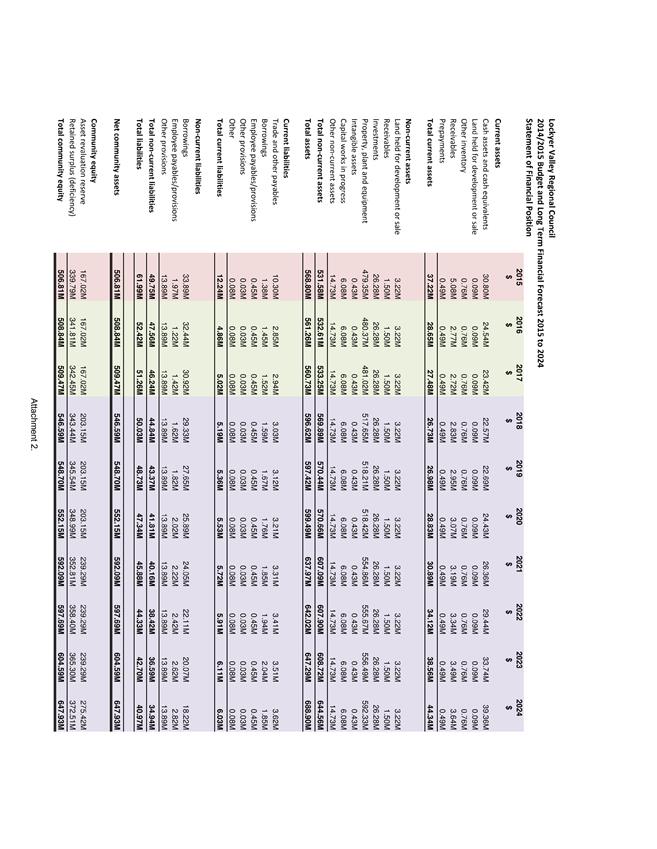

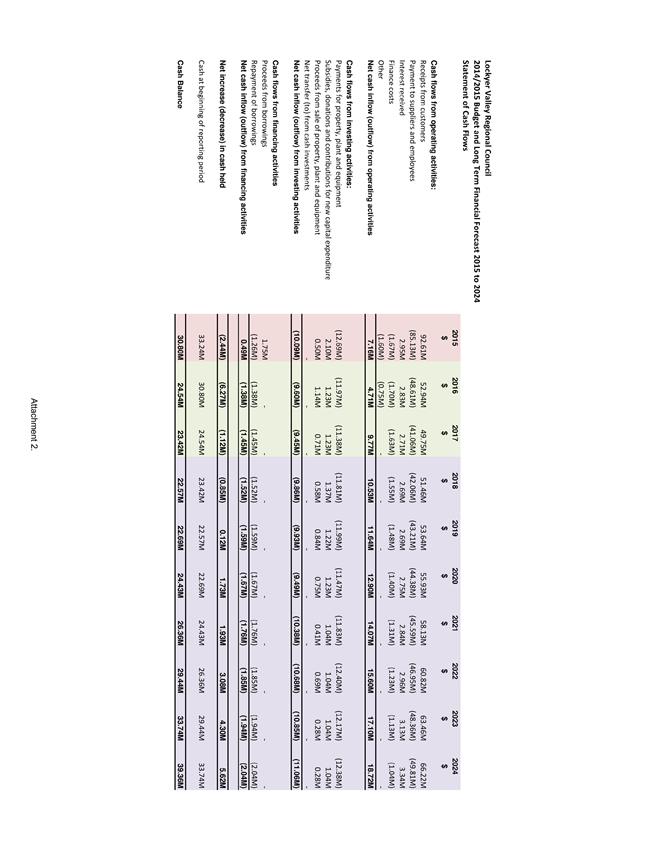

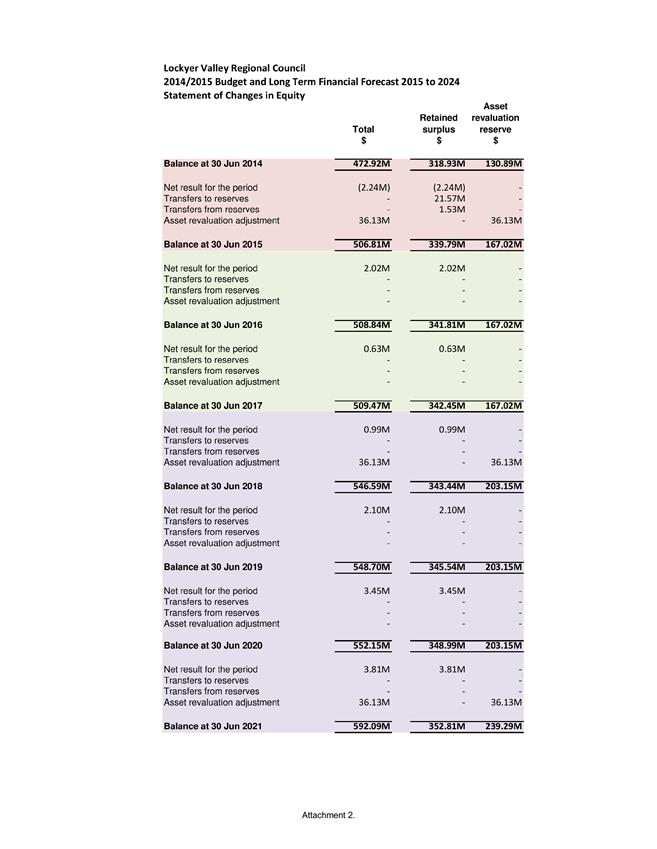

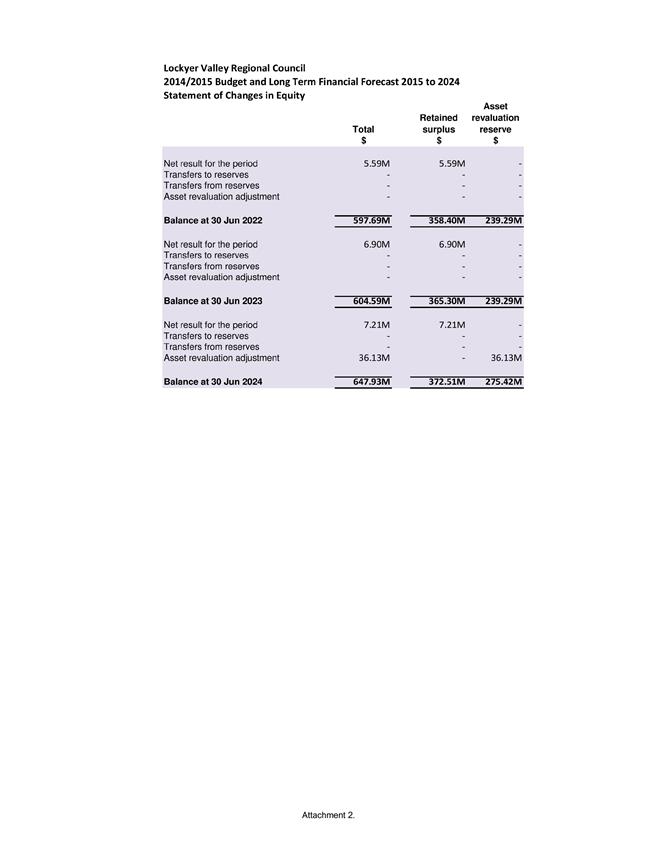

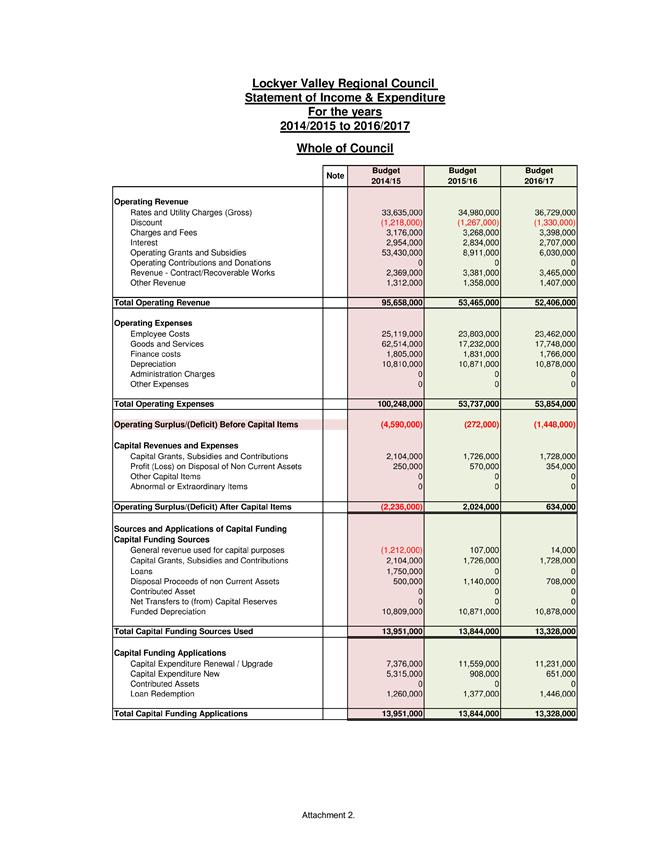

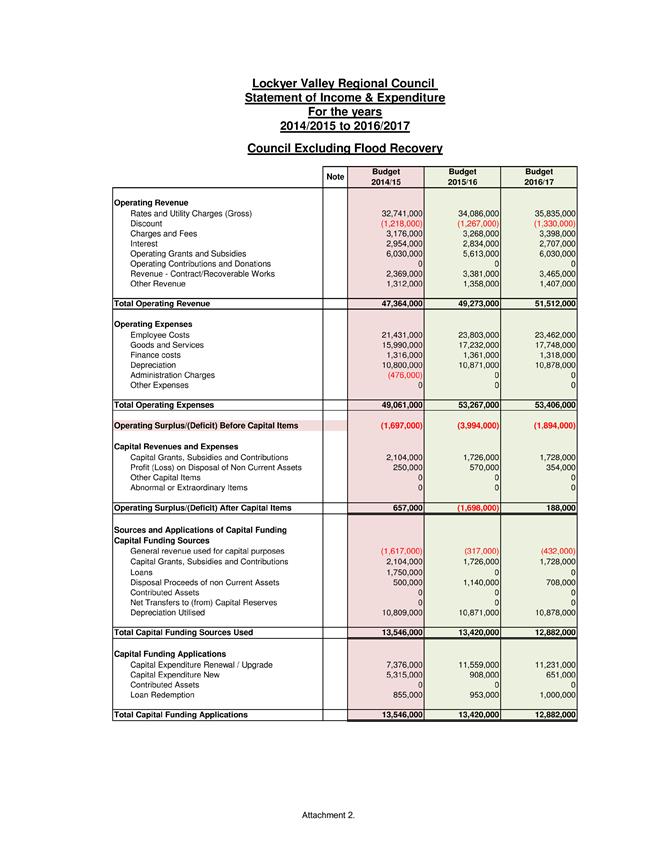

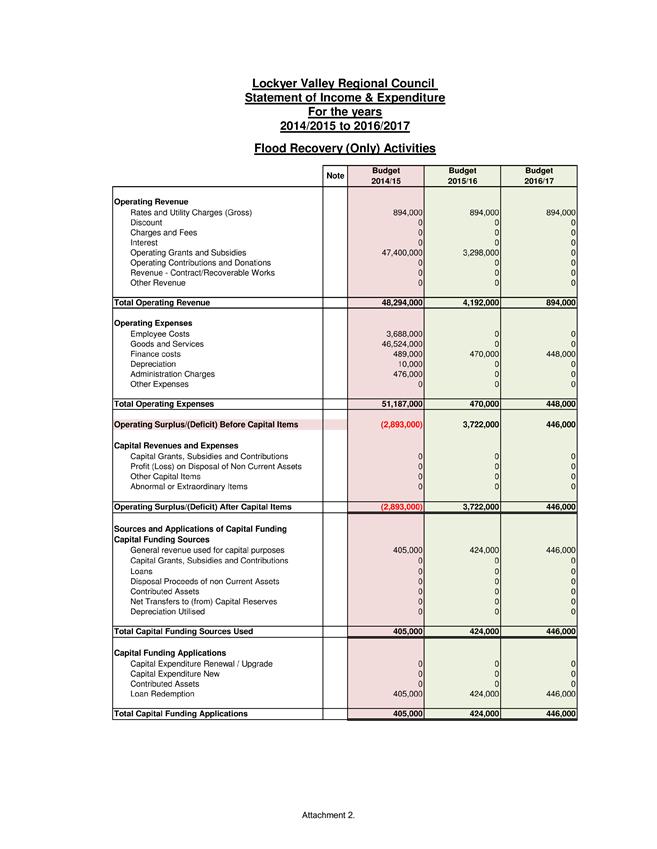

b. Adopt the Budget for the financial year 2014/2015 and the long term financial forecast for the financial years 2014/2015 to 2023/2024 as contained in the document entitled 2014/2015 Budget and Long Term Financial Forecast (Attachment 2) and set out in the pages contained therein:

i. Statement of Income and Expenditure.

ii. Statement of Financial Position.

iii. Statement of Cash Flows.

iv. Statement of Changes in Equity.

v. Relevant Measures of Financial Sustainability.

vi. Detailed Statements of Income and Expenditure:

1. Whole of Council 2014/2015 to 2016/2017

2. Council Excluding Flood Recovery 2014/2015 to 2016/2017

3. Flood Recovery 2014/2015 to 2016/2017

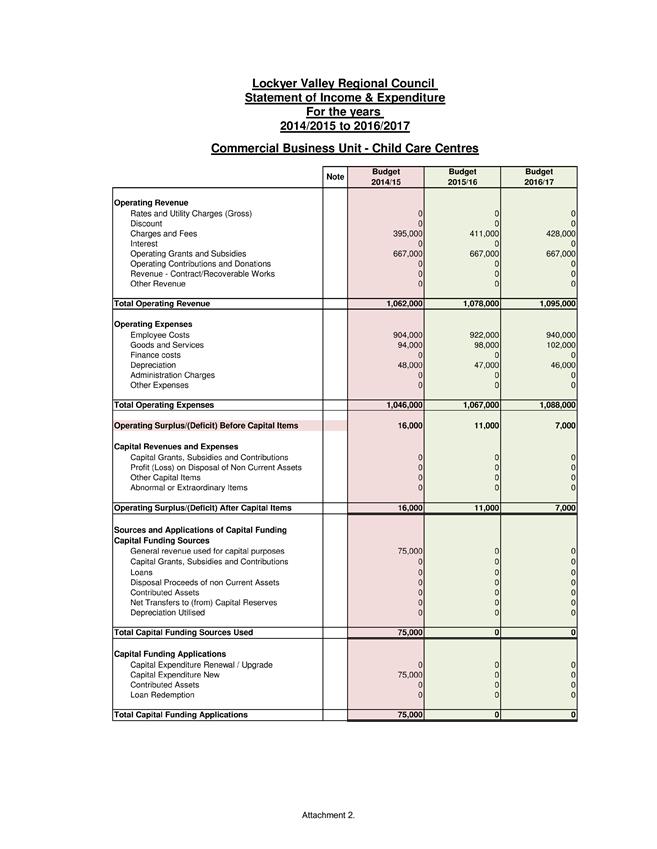

4. Commercial Business Unit – Child Care Centres 2014/2015 to 2016/2017

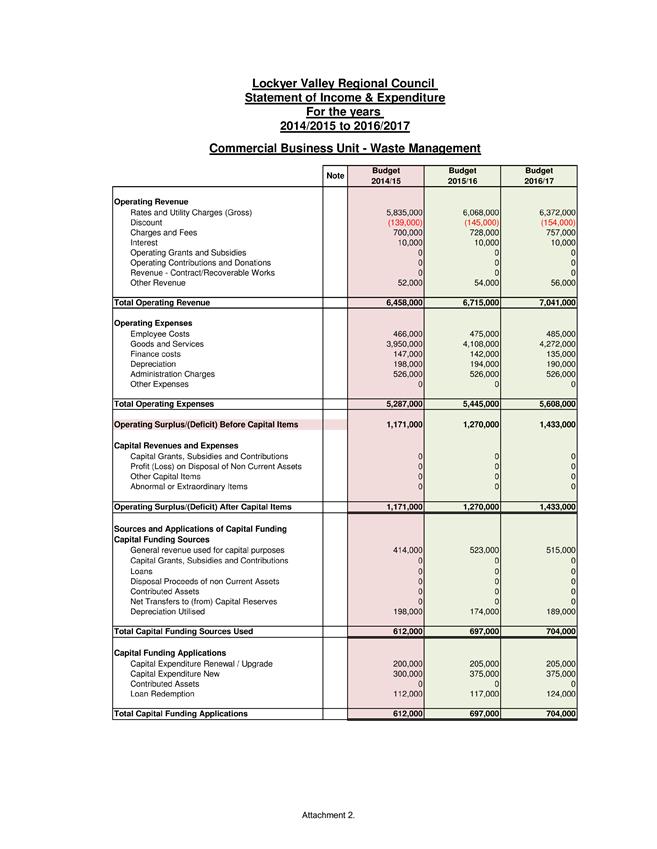

5. Commercial Business Unit – Waste Management 2014/2015 to 2016/2017

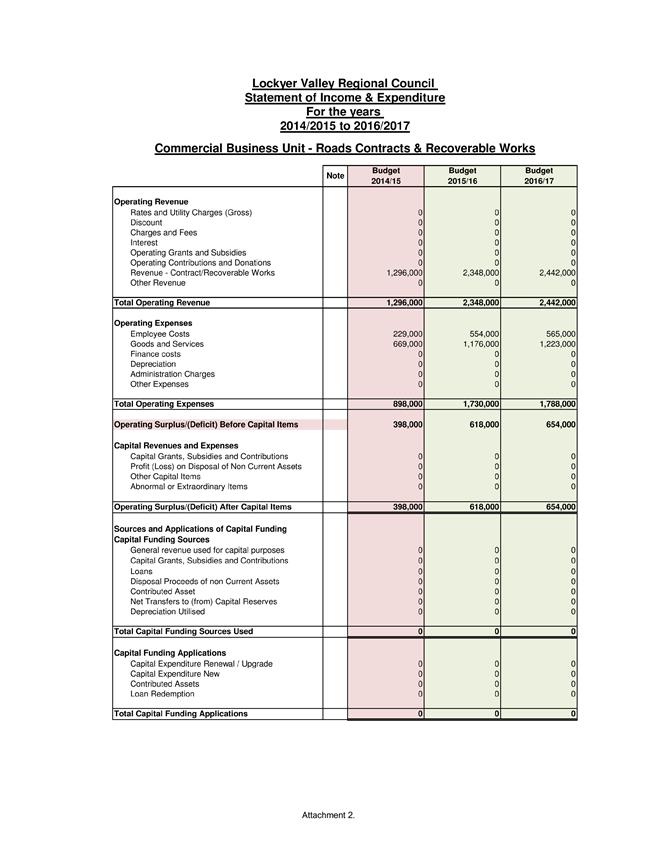

6. Commercial Business Unit – Roads Contracts and Recoverable Works 2014/2015 to 2016/2017

vii. Percentage Change in Rates Levied from 2013/2014.

|

THAT Council resolves to a. Note the Statement of Estimated Financial Position at 30 June 2014 (Attachment 1), as presented by the Chief Executive Officer in accordance with Section 205 of the Local Government Regulation 2012.

b. Adopt the Budget for the financial year 2014/2015 and the long term financial forecast for the financial years 2014/2015 to 2023/2024 as contained in the document entitled 2014/2015 Budget and Long Term Financial Forecast (Attachment 2) and set out in the pages contained therein: i. Statement of Income and Expenditure. ii. Statement of Financial Position. iii. Statement of Cash Flows. iv. Statement of Changes in Equity. v. Relevant Measures of Financial Sustainability. vi. Detailed Statements of Income and Expenditure: 1. Whole of Council 2014/2015 to 2016/2017 2. Council Excluding Flood Recovery 2014/2015 to 2016/2017 3. Flood Recovery 2014/2015 to 2016/2017 4. Commercial Business Unit – Child Care Centres 2014/2015 to 2016/2017 5. Commercial Business Unit – Waste Management 2014/2015 to 2016/2017 6. Commercial Business Unit – Roads Contracts and Recoverable Works 2014/2015 to 2016/2017 vii. Percentage Change in Rates Levied from 2013/2014.

Moved By: Cr Pingel Seconded By: Cr Holstein Resolution Number: 3556

CARRIED 5/0 |

Report

1. Introduction

This report presents the 2014/2015 Budget and forward estimates for the Lockyer Valley Regional Council for adoption as part of the 2014/2015 Budget process.

2. Background

Sections 169 and 170 of the Local Government Regulation 2012 prescribe the requirements for the adoption of Council’s budget. This report complies with the disclosure requirements of the Local Government Regulation 2012.

3. Report

The 2014/2015 budget will begin the process of realigning Council’s operations back to a sustainable level following the flood events of the past few years. As the flood restoration program nears completion, Council will return its focus to delivering its core services to the community in an efficient and cost effective manner. Saving initiatives contained in this budget will set the scene for Council’s future sustainability.

Under the Local Government Regulation 2012, Council must prepare an accrual based budget for each financial year which is consistent with the 5-year Corporate Plan and Annual Operational Plan. To comply with the Local Government Regulation 2012, Council must also publish results against a series of measures of financial sustainability for the budget year and the next nine (9) years.

To meet the legislative requirements, included in the 2014/2015 Budget (Attachment 2) are the following financial statements:

· Statement of Income and Expenditure.

· Statement of Financial Position.

· Statement of Cash Flows.

· Statement of Changes in Equity.

· Relevant Measures of Financial Sustainability.

· Detailed Statements of Income and Expenditure

o Whole of Council 2014/2015 to 2016/2017

o Council Excluding Flood Recovery 2014/2015 to 2016/2017

o Flood Recovery 2014/2015 to 2016/2017

o Commercial Business Unit – Child Care Centres 2014/2015 to 2016/2017

o Commercial Business Unit – Waste Management 2014/2015 to 2016/2017

o Commercial Business Unit – Roads Contracts and Recoverable Works 2014/2015 to 2016/2017

· Percentage Change in Rates Levied from 2013/2014.

The Statement of Income and Expenditure, Statement of Financial Position, Statement of Cash Flows and Statement of Changes in Equity have all been prepared on an accrual basis and contain Council’s long tern financial forecast as well as the budgets for 2014/2015 and the following two years.

The budget must also contain Council’s Revenue Policy and Revenue Statement which due to the complex nature of the Revenue Statement, will be adopted via a separate report.

The 2014/2015 Budget presents an operating deficit of $2.24 million, including Council operations of $49.06 million, an infrastructure recovery program of $51.19 million and a capital works program of $13.95 million.

At a glance, some of the key highlights of the budget include:

· a total works program of $103.4 million (excluding depreciation);

· an overall nil general rate increase with respect to Urban Residential, Rural Residential and the Agricultural sectors. Noting that the rates levied on individual properties will vary in accordance with their valuation adjustment circumstances;

· the continuation of the waste recycling scheme, with $10 per annum added to domestic waste collection charges and $5 per annum added to the Waste Management charge to fund this service;

· removal of the separate charge – State Emergency Service Levy;

· removal of the separate charge - Environmental Levy;

· the separate charge - Disaster, Restoration & Resilience Levy has been renamed the Emergency Preparedness Levy and is to be applied to fund infrastructure projects through agreed community recovery programs and recurrent and capital expenditure for volunteer state emergency service units;

· retention of early payment discounts of 5% on general rates and waste collection charges; and

· retention and increase in the amount of pensioner remissions.

Brief discussions on each of the major line items of the budget are outlined below.

Revenue

Net Rates and Utility Charges

Full details of Council’s rates and utility charges are outlined in Council’s revenue statement which is the subject of a separate report. Total budgeted rates and utility charges for the year is $33.64 million with estimated discounts of $1.22 million.

Charges and Fees

After allowing for the reclassification of some revenue items, Charges and fees are anticipated to decrease by approximately $0.15 million in 2014/2015. This small decrease reflects the current level of activity within the local economy.

Interest Received from Investments

Interest from investments will be approximately $0.30 million higher than the 2013/2014 financial year due to higher cash holdings associated with Council reconstruction works and an anticipated increase in interest rates over the year.

Operating Grants and Subsidies

Major grants and subsidies include infrastructure recovery $47.40 million, and the Commonwealth Government’s financial assistance grant of $4.10 million. The freeze on the financial assistance grants announced as part of the 2015 Federal Budget has been included in the budget.

Contract/Recoverable Works

General recoverable works have increased by of $1.74 million in 2014/2015 due to increased opportunities for contracts with Main Roads.

Expenditure

Employee Costs

Employee costs represent the operational employee costs of the organisation and include all employee related expenditure including items such as superannuation, fringe benefits tax and workers compensation insurance.

Employee costs have been decreased by $4.54 million or 15.3% in the 2014/2015 budget. This decrease is contingent upon anticipated reductions in Council’s employee costs following the completion of the flood recovery program, a review of existing vacant positions and a review of services provided by Council.

Goods and Services

The budget for goods and services has increased by $13.96 million against the 2013/2014 Budget reflecting the anticipated increase in recovery works of $12.58 million with the balance of additional costs associated with new facilities that Council is bringing online during the 2014/2015 year. Expenditure items have been also increased by applicable allowances for growth and price.

Organisational efficiencies of $0.5 million have also been incorporated into the goods and services budget.

Finance Costs

This line item is mainly made up of interest on Council’s loans from Queensland Treasury Corporation. Finance costs have increased by approximately $0.06 million mainly due to the interest on additional loans taken up in the 2013/2014 year associated with upgrades to Council information technology systems and other infrastructure works.

Depreciation

Depreciation expenses of $10.8 million are envisaged in the 2014/2015 Budget. There may be some change in this line item during the year as reviews of Council asset management plans, asset replacement values and useful lives are completed.

Capital

The main sources of capital funding are depreciation $10.8 million, grants and subsidies of $2.1 million and loan proceeds of $1.75 million.

These funding sources will be used for the construction or acquisition of assets worth $12.69 million and loan principal repayments of $1.26 million.

Financial Sustainability

Under the Local Government Regulation 2012, Council must prepare an accrual based budget for each financial year which is consistent with five (5) year corporate plan and annual operational plan. To comply with the Local Government Regulation 2012, Council must also publish results against a series of measures of financial sustainability for the budget year and the next nine (9) years.

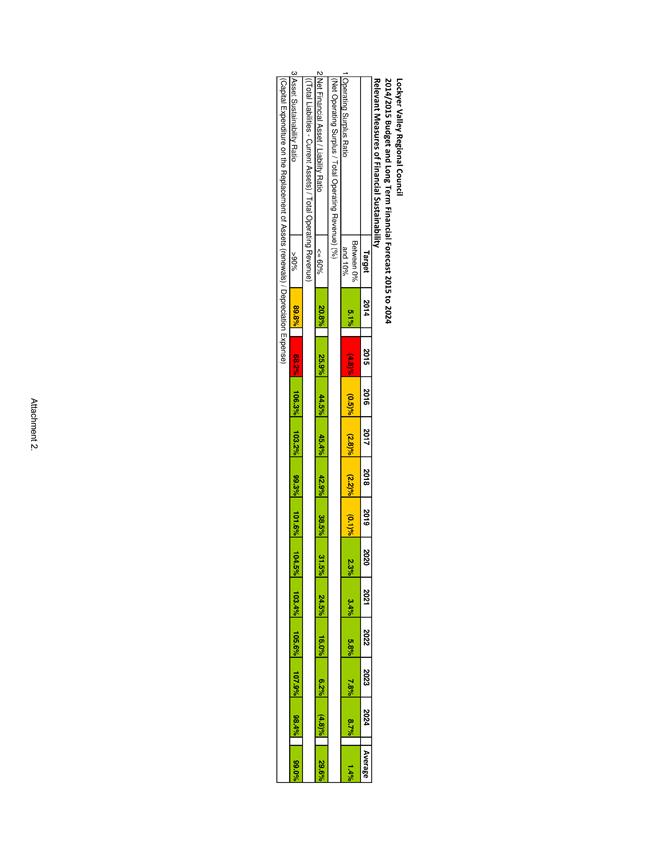

The 2014/2015 Budget results against each relevant measure of financial sustainability are given in the following table.

|

Relevant Measure of Financial Sustainability |

Result |

LGA Indicator |

|

Asset Sustainability Ratio |

68.2% |

greater than 90% |

|

Net Financial Liabilities Ratio |

25.9% |

not greater than 60% |

|

Operating Surplus Ratio (excluding capital revenue) |

-4.8% |

between 0% and 10% |

The results for the full ten years are included in Attachment 2.

Commercial Business Units

The estimated costs of Council’s commercial business units have been shown in separate schedules in Attachment 2. The budgeted results of Council’s Commercial Business Units for the 2014/2015 year are as follows:

|

Unit |

Income |

Expenditure |

Operating Surplus |

|

Child Care Centres |

$1.06 million |

$1.05 million |

$0.01 million |

|

Waste Management |

$6.46 million |

$5.29 million |

$1.17 million |

|

Roads Contracts and Recoverable Works |

$1.30 million |

$0.90 million |

$0.40 million |

|

Total |

$8.82 million |

$7.24 million |

$1.58 million |

Statement of Estimated Financial Position 2013/2014

Section 205 of the Local Government Regulation 2012 requires the CEO to present Council with a Statement of Estimated Financial Position at the annual budget meeting. This Statement is at Attachment 1 and is the estimated financial results for the whole of Council as at 30 June 2014. The result is an estimated deficit of $2.57 million. It should be noted that the amounts shown in this report are still subject to audit adjustments and will change as the end of year process is completed until the audit is finalised in early September. Detailed financial analysis of the result will be provided once this process is complete. The estimated deficit will also inhibit Council’s ability to fund 2013/2014 carry-over capital works.

4. Policy and Legal Implications

Under the Local Government Regulation 2012, council must prepare an accrual based budget for each financial year which is consistent with council’s 5-year Corporate Plan and Annual Operational Plan. To comply with the Local Government Regulation 2012, council must also publish results against a series of measures of financial sustainability for the budget year and the next nine (9) years.

5. Financial and Resource Implications

The operating result is largely contingent upon anticipated reductions in Council’s employee costs following the completion of the flood recovery program, a review of existing vacant positions and a review of services provided by Council.

There are also a number of critical assumptions around rates growth and contract works which will need to be carefully monitored and managed over the next two years to ensure that Council achieves its forecasted operating results.

Should these and other savings measures not be realised, the impact on Council’s future sustainability will not be insignificant. If Council can contain its costs and achieve the gains in revenue outlined in the 2014/2015 Budget and forward estimates, Council is forecasted to achieve a balanced operational budget in 2019.

6. Delegations/Authorisations

No further delegations are required to manage the issues raised in this report. The Chief Executive Officer will manage the requirements in line with existing delegations.

7. Communication and Engagement

The implications of the financial statements will be incorporated into extensive communications associated with the 2014/2015 Budget.

8. Conclusion

Sections 169 and 170 of the Local Government Regulation 2012 prescribe the requirements for the adoption of Council’s budget. This report complies with the requirements of the regulation.

9. Action/s

Publish the adopted budget on Council’s website.

Extensive 2014/2015 Budget communications.

Distribute to internal staff.

|

|

Attachment 1 Statement of Estimated Financial Position 2013/2014 |

|

Adoption of the 2014/2015 Budget and Long Term Financial Forecast from 2014/2015 to 2023/2024 |

Attachment 2 Budget & Long Term Financial Forecast |

|

14 JULY 2014 |

Following the adoption of all reports and budget resolutions, the Mayor asked Councillors and officers for any further comments on the budget as proposed and adopted.

The Executive Manager Corporate and Community Services presented the key budget outcomes which provide a sound foundation for the Council’s long term financial sustainability.

The Chief Executive Officer thanked Councillors and the Executive team for working with the Mayor in the preparation of the budget and further thanked the dedicated staff who had worked hard to develop and deliver the budget. The Chief Executive Officer committed the organisation to providing the cost savings performance envisaged in the compilation of the budget and recognised that the budget implementation is a key priority for the Executive to action with regular progress reports to Council.

There being no further business the meeting closed at 10.36 am.